Unlocking Your Path to Homeownership with MortgageWithPaul.ca

Owning a home is one of the most significant investments you'll ever make, and navigating the mortgage landscape can often feel overwhelming. Fortunately, MortgageWithPaul.ca is here to guide you through this intricate process with personalized service, expertise, and a commitment to helping you achieve your homeownership dreams. In this comprehensive article, we will explore the key aspects of mortgage services, the benefits of choosing Paul as your mortgage expert, and tips to secure the best mortgage for your needs.

The Importance of Understanding Mortgages

Before diving into the world of mortgages, it's essential to understand what a mortgage is. A mortgage is a loan specifically used to purchase real estate, where the property serves as collateral. Understanding the components of a mortgage is crucial, as it can significantly affect your financial future.

Key Components of a Mortgage

- Principal: This is the amount you borrow to purchase your home. It is the foundation of your mortgage and the amount that will accrue interest over time.

- Interest Rate: This is the cost of borrowing the principal, expressed as a percentage. Rates can be fixed or variable, impacting your monthly payments and overall cost.

- Loan Term: The duration over which you repay the mortgage, typically ranging from 15 to 30 years. The term affects both your monthly payments and the total interest paid.

- Down Payment: The initial amount you pay towards the property, usually expressed as a percentage of the purchase price. A higher down payment can reduce your loan principal and potentially lower your interest rate.

- Amortization: This refers to the process of paying off your mortgage through regular installments over the loan term, which consists of both principal and interest components.

Why Choose MortgageWithPaul.ca for Your Mortgage Needs?

When it comes to selecting a mortgage broker, experience, expertise, and personalized service are paramount. MortgageWithPaul.ca offers a unique blend of all three, positioning itself as a top choice for prospective homebuyers in Canada.

Personalized Service

At MortgageWithPaul.ca, the focus is on you—the client. Paul understands that each client will have unique needs and circumstances, whether you're a first-time homebuyer or looking to refinance your existing mortgage. He offers tailored solutions and guidance, ensuring you choose the mortgage option that aligns with your financial goals.

Expert Knowledge of the Canadian Market

Understanding the local real estate market is critical in the mortgage process. Paul possesses in-depth knowledge of the Canadian property landscape, market trends, and the various mortgage products available. This expertise enables him to provide clients with relevant information and competitive rates, helping you make informed decisions.

Access to a Wide Range of Lenders

One of the significant advantages of working with MortgageWithPaul.ca is the access to multiple lenders. Paul has established relationships with various banks and financial institutions across Canada, allowing him to shop around for the best rates and terms on your behalf. This not only saves you time but also ensures you secure the best possible deal.

Steps to Obtaining a Mortgage with MortgageWithPaul.ca

Securing a mortgage involves several steps. Here is a detailed guide to what you can expect when working with Paul:

1. Initial Consultation

Your journey begins with an initial consultation where Paul will assess your financial situation, discuss your homeownership goals, and answer any questions you may have about the mortgage process.

2. Pre-Approval Process

Paul will help you get pre-approved for a mortgage, which involves evaluating your creditworthiness and financial status. This step is crucial as it will give you a clear picture of how much you can afford and strengthen your position when making an offer on a property.

3. Choosing the Right Mortgage

During this phase, Paul will present you with various mortgage options, explaining the pros and cons of each. Whether you're looking for a fixed-rate, variable-rate, or alternative financing options, Paul will ensure you understand each product's implications.

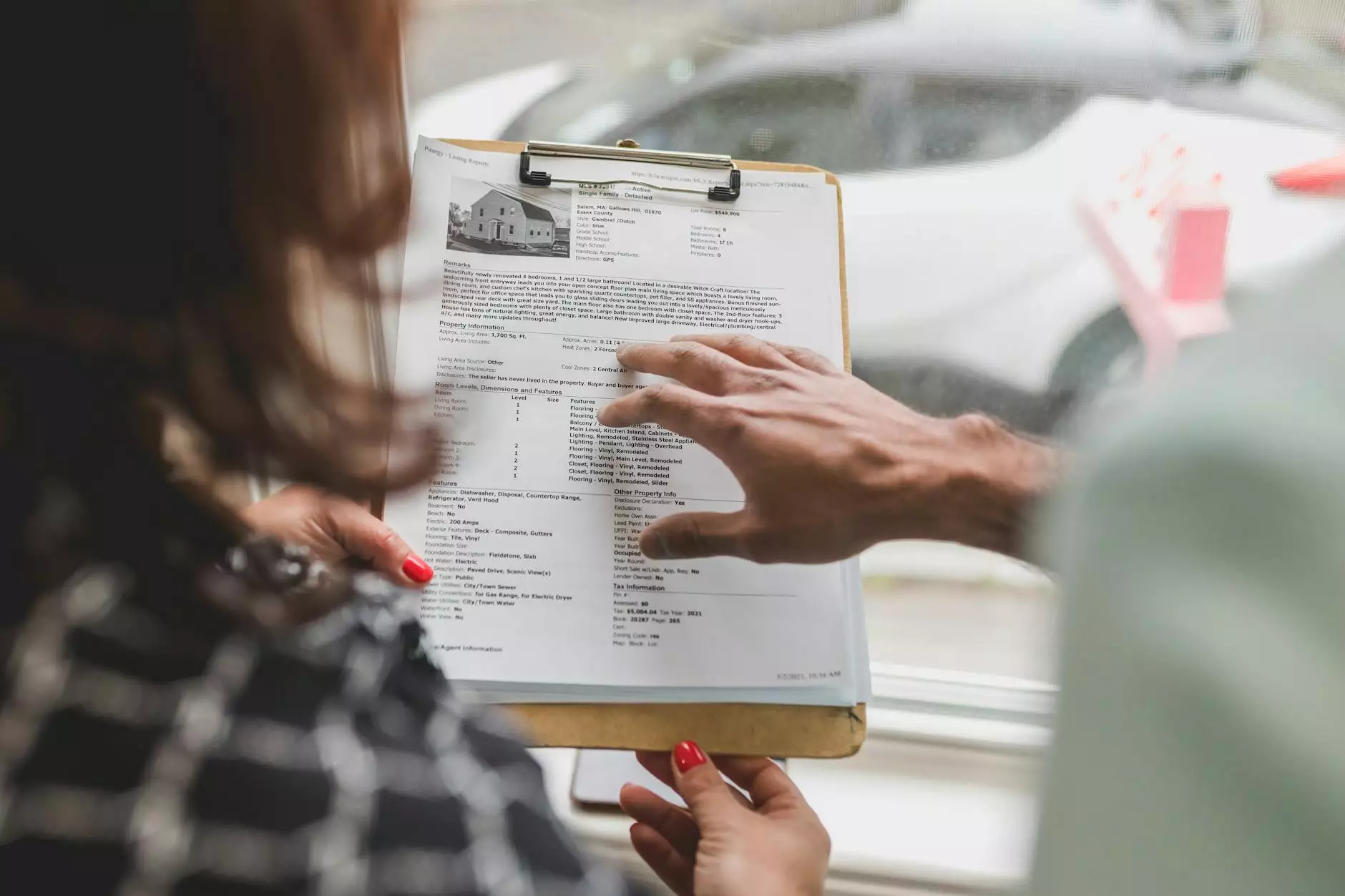

4. Documentation and Application

Once you’ve chosen a mortgage product, Paul will guide you through the paperwork required for the application. This includes essential documents such as proof of income, credit history, and employment verification.

5. Mortgage Approval

After submitting your application, the lender will review your information and grant a mortgage approval. Paul will keep you informed throughout this process, ensuring you understand each step and what to expect.

6. Closing the Deal

The final step involves closing the deal where you'll sign documents, pay closing costs, and receive the keys to your new home! Paul will be there to ensure the process is smooth and hassle-free.